The online commerce landscape has changed dramatically since shopping on the internet first began gaining traction in the mid to late 1990?s. Early adopter e-commerce companies founded on technology enjoyed a head-start over traditional brick and mortars who were slow to respond to consumer spending shifting online. Initially, some tried to solve the problem by simply throwing money at it; as recently as 2009, some brick and mortars were still spending up to nearly $300,000 per day on paid search.

The last 12-18 months have seen traditional brick and mortar companies step up their game when it comes to online commerce. Tech writer Farhad Manjoo recently reported at Fast Company that Walmart is investing millions in technology to fight e-commerce leaders, even recruiting a key engineer in silicon valley who built much of eBay?s infrastructure to head their tech team. The New York Times recently described how Target has recently rebuilt much of their website to be more technology friendly and user-centric.

Online Search is Central to E-Commerce Success

A major component of the online commerce battle is visibility in the search engines. Data shows search engines have the highest influence on online purchase behavior, more than alternative sources such as social networks and recommendation engines.

To check in on how brick and mortars did versus pure e-commerce players this holiday season we tracked three hundred of the most popular products across three of the most popular product categories on PriceGrabber:

? Electronics

? Toys

? Jewelry

In selecting the most in-demand products across three categories on popular shopping engine PriceGrabber, we ended up with a good sampling of some of the most in-demand products this holiday season (note: PriceGrabber regularly updates the most in demand products based on shifting consumer demand. Our list was pulled the first week of December).

We entered the top 100 products in each category into Searchlight, Conductor?s Enterprise SEO Platform, and tracked the domains that appeared in top ranking positions (position 1-5) for each keyword on Google. To determine how prevalent e-commerce websites are vs. traditional brick and mortars in the search results, we then categorized each domain that appeared in the top search results into one of four website types:

- E-Commerce: A pure e-commerce player

- Brick and Mortar: Any retailer with a brick and mortar presence

- Shopping Engine: A shopping engine such as Nextag.com and Bizrate.com

- Other: Non-retailers (e.g. Wikipedia, CNET?)

After Years of Growing Pains, Brick and Mortars Make Significant Headway in E-Commerce

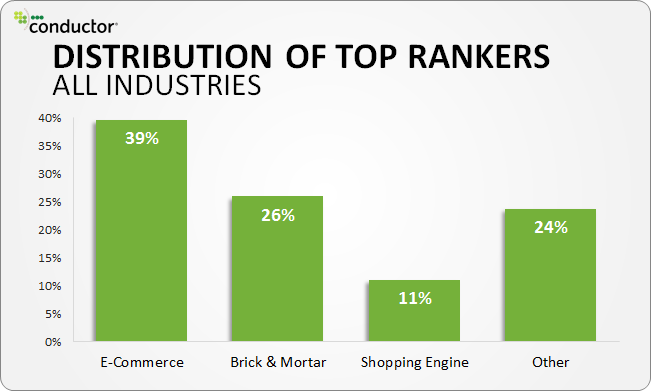

Looking at the results for all 300 keywords together we can see that e-commerce sites appeared in top ranking positions (1-5) 39% of the time while brick and mortars appeared more than a quarter (26%) of the time. While we do not have historical data for comparative purposes, and we see e-commerce players overall still appearing at the top of the results most often, we would hypothesize that brick and mortars have made substantial inroads in the search results. In fact, we?ve reviewed enough data over the years to know their percentages would have been substantially lower at this time one year ago, and lower still two years ago.

Indeed, anecdotal evidence of this conclusion is that in that time frame (the last two years or so) we see several large brick and mortars transitioning their search strategies from a ?throw-money-at-the-problem-via-paid search? short term approach to a long-term ?gradually-move-up-the-natural-search-rankings where 92% of the clicks occur? approach; some of our historical data shows one major brick and mortar retailer reduced their paid search spend by more than 85% in that time frame. And, the brick and mortars that the media cite as increasingly giving mindshare to online commerce (Walmart and Target) are those that now appear most often in the search results.

Brick and Mortars Beating E-Commerce Websites in the Toys Industry

Looking at the results for the individual industries we see that in ?Toys?, brick and mortars are actually outranking e-commerce players (34% to 30%). This is likely reflective of the focused efforts in the search results of brick and mortars such as Toys R Us and Target over the last several years. Consumer spending on toys during the holiday season also likely shifted online faster than products such as bulky consumer electronics and costly jewelry, giving toy brick and mortars a bigger head start working in the search results than the other industries.

Top Winners

Looking at top rankers across all website types in all product categories, it is clear that Amazon remains a dominant force in e-commerce search visibility due to their unparalleled product selection, long-time investment in technology, and unmatched user reviews which the search algorithms increasingly value post Panda/Penguin algorithm updates.

However, for the reasons described above and in contradistinction to just a few short years ago, traditional brick and mortars are shown to have a strong presence in the search results, with brick and mortars Walmart and Target appearing second and third most often in top ranking positions across all product categories. Additionally, Target and Toys R Us in toys and Best Buy in electronics were strong influencers in their respective industries.

In [the last two years or so] we see several large brick and mortars transitioning their search strategies from a ?throw-money-at-the-problem-via-paid search? short term approach to a long-term ?gradually move up the natural search rankings where 92% of the clicks occur? approach[...]

Conclusion: Brick and Mortars are Now a Force to be Reckoned with in Online Retail

Only a few short years ago young, nimble internet players were the nouveau riche of the online commerce game, while traditional brick and mortars were the lumbering giants struggling to figure out the internet thing. Now, after several years of focused effort it?s clear that brick and mortars are making serious inroads in online commerce?transitioning to more mature search strategies and now, even capturing more of the top rankings in the Toys industry than e-commerce sites. As we head into 2013 and leave the holiday season behind us, it is clear that brick and mortars are investing in the technology and long term approaches that have turned them into a force to be reckoned with in online commerce.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.